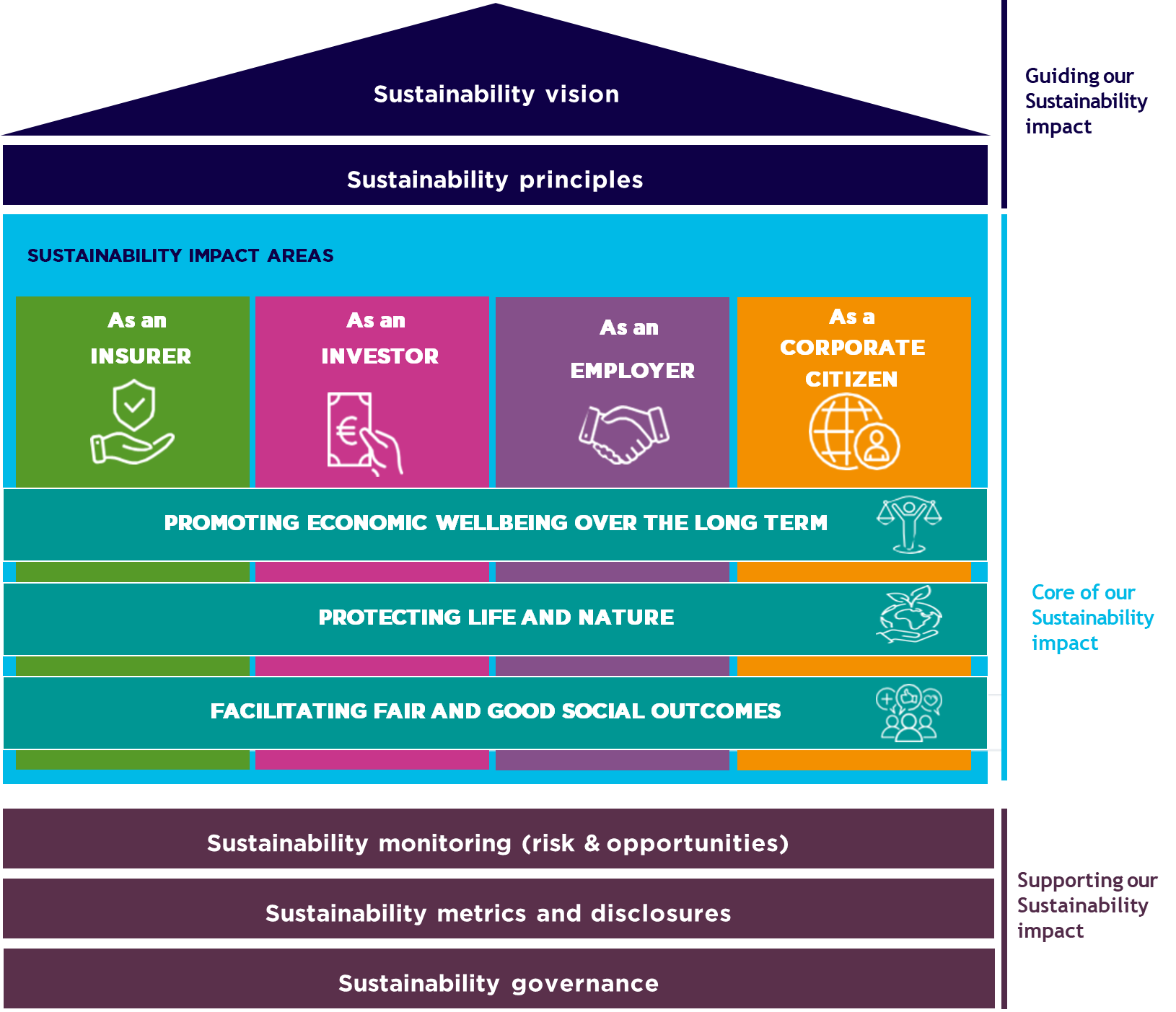

Sustainability framework

At its core, the provision of lifelong financial stability and prosperity is a societal need that Athora has set out to address since inception. We aim to provide long-term value and security for all of our stakeholders, while going beyond financial comfort to ensure that our work enables our customers, employees, communities, and the planet to thrive.

We recognise the important role we have to play in contributing to a biodiverse planet, a stable climate, and to creating economically and socially strong communities. Our Group-wide Sustainability Strategy sets out how we put our beliefs into action, delivering on our commitments by advancing meaningful activities. This is summarised in our sustainability framework, which reflects our embedding of sustainability at Athora.

Core Sustainability Themes

We remain focused on three sustainability themes which reflect our industry role, strengths and values. These themes are aligned with several of the United Nations Sustainable Development Goals:

Promoting economic wellbeing over the long term: We provide economic wellbeing to our insurance customers over the long term, and we are well positioned to broaden our role in this area and thereby increase our impact by engaging with our communities and promoting financial literacy.

Protecting life and nature: We recognise our shared responsibility to look after nature and combat climate change, from managing our own environmental footprint to contributing to (and investing in) initiatives aimed at protecting, conserving and restoring the environment.

Facilitating fair and good social outcomes: We are committed to facilitating good social outcomes, including fairness and equality within our organisation and wider society, from reviewing our own people processes and policies to our investment in (and contributions to) broader initiatives.

Sustainability Impact Areas

Our role as an insurer

Through our products, Athora provides customers and their families with financial security, stability and reassurance - enabling them to plan for the future with confidence.

Our role as an investor

Our role as an investor

Through our investment activities we aim to deliver long-term returns for our customers and policyholders, while making a positive, real, and measurable impact on the economy, communities, and planet wherever possible.

Our role as an employer

Our role as an employer

We are focused on recruiting, retaining and engaging the best talent to help us achieve our strategic ambition. We offer an inclusive environment and collaborative culture where employees can perform effectively, are rewarded, recognised, valued and able to fulfil their potential.

Our role as a corporate citizen

Our role as a corporate citizen

By considering our communities and planet in what we do and how we do it, we also earn the trust of our customers and wider society in the handling of their assets, while contributing positively to the reputation of the financial system.